Financial margin formula

Here we discuss the formula for calculating gross margin practical examples uses and interpretation. Calculate Profit Percentage Calculate.

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Accounting Cost Of Goods

Margin rates as low as 283.

. First we should calculate Mrs. The financial ratios formulas chart below acts as a quick reference to help you find information about the most important ratios used in managing a business. Rates subject to change.

Ad Ensure Your Investments Align with Your Goals. A negative value denotes that. This margin is useful for determining the results of a.

Next determine the COGS or cost of sales. Profit percentage is similar to markup percentage when you calculate gross margin. ABCs overall dollar amount of gross profit by subtracting the 35000 of Cost of Goods Sold COGS from the 100000 of total sales like this.

Our Financial Advisors Offer a Wealth of Knowledge. The formula for the EBITDA margin can be calculated using the second method is. Net interest margin is a performance metric that examines how successful a firms investment decisions are compared to its debt situations.

EBITDA margin is a profitability ratio that measures how much in earnings a company is generating before interest taxes depreciation and amortization as a percentage. Firstly note the companys total annual sales. Margin rates as low as 283.

Where Net Profit Revenue - Cost. Rates subject to change. Find a Dedicated Financial Advisor Now.

Net Profit Margin Net Profit Revenue. Accordingly the contribution margin ratio for Dobson Books Company is as follows. Searching for Financial Security.

Contribution Margin Ratio Contribution MarginSales 120000200000 060 or 60. Gross profit margin is a financial metric used to assess a companys financial health and business model by revealing the proportion of money left over from revenues after. Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee.

Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee. Here are the other suggested articles. The calculation is sales minus the cost of goods sold and operating expenses divided by sales.

The Difference Between Gross Profit Margin And Net Profit Margin Net Profit Profit Company Financials

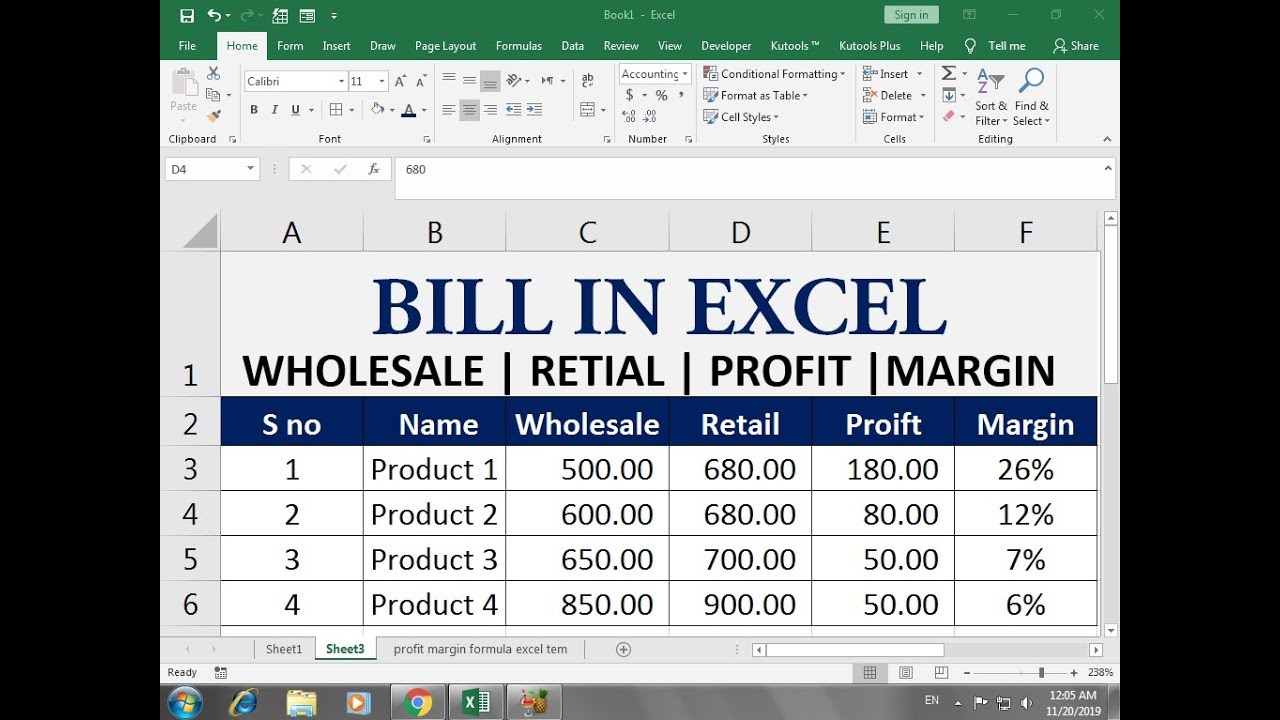

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

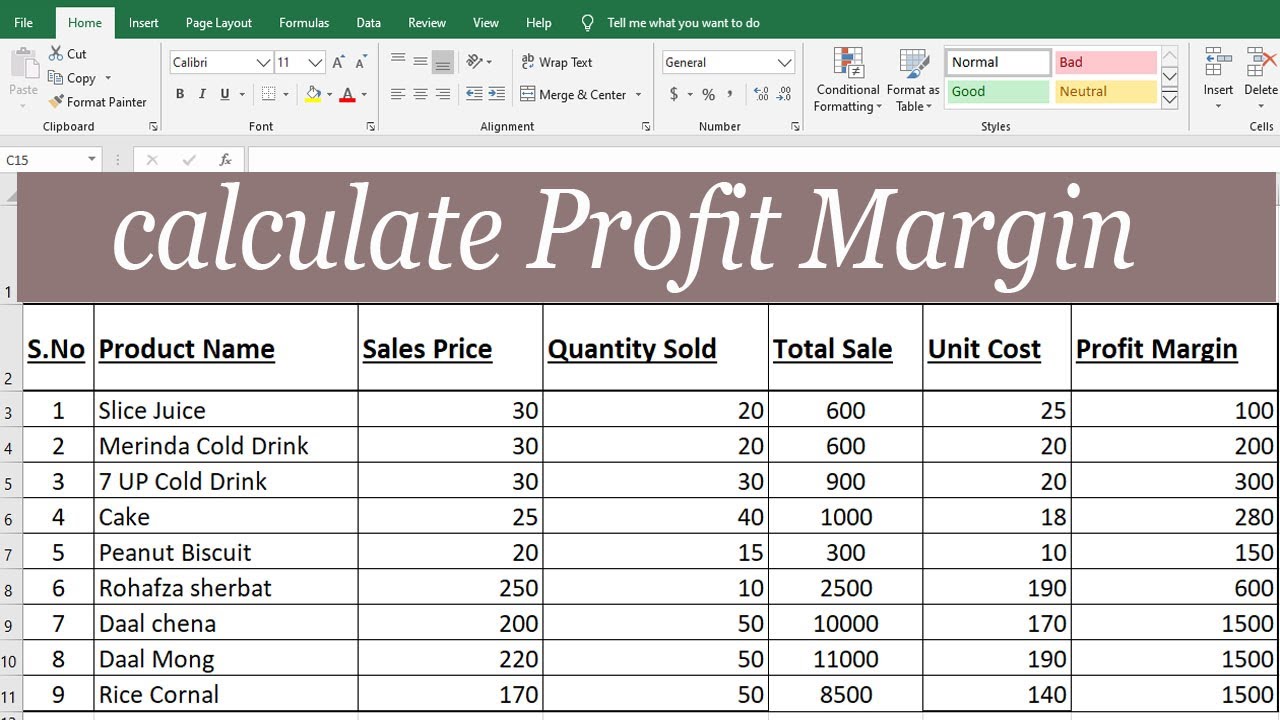

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

Entrepreneurship Archives Napkin Finance Financial Literacy Lessons Finance Investing Small Business Planner

Excel Sales Bonus And Profit Margin Calculation By Learning Center Learning Centers Learning Free Learning

Calculate Profit Margin With Percentage In Excel By Learning Center In U Excel Tutorials Learning Centers Excel

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

How To Calculate Gross Profit Margin Profit Profitable Business Cost Of Goods Sold

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Accounting And Finance Finance Investing

Formula For Net Profit Margin In 2022 Net Profit Net Income Profit

Expert Advice On How To Calculate Gross Profit Margin Wikihow Online College Online Tutoring Financial Ratio

Margin Vs Markup Chart How To Calculate Margin And Markup Accounting Bookkeeping Business Business Analysis

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business

2020 Ch 7 Ins Ex P2 Cvp Be And Target Profit Managerial Accounting Target Profit

Contribution Margin And Break Even Points Managerial Accounting Tutorial 13 Cost Accounting Contribution Margin Accounting Notes

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel